Stonewell Bookkeeping - Questions

Table of ContentsThe 8-Minute Rule for Stonewell BookkeepingThe Ultimate Guide To Stonewell BookkeepingStonewell Bookkeeping - The FactsStonewell Bookkeeping Things To Know Before You BuyStonewell Bookkeeping - The Facts

Rather than experiencing a declaring cabinet of different records, invoices, and invoices, you can present detailed documents to your accounting professional. In turn, you and your accountant can save time. As an added reward, you may even be able to recognize potential tax write-offs. After using your accounting to submit your taxes, the internal revenue service may choose to execute an audit.

That financing can be available in the type of proprietor's equity, grants, organization lendings, and capitalists. Investors need to have a good idea of your business prior to investing. If you do not have accountancy documents, financiers can not establish the success or failing of your firm. They need up-to-date, accurate details. And, that details needs to be conveniently easily accessible.

The Basic Principles Of Stonewell Bookkeeping

This is not intended as lawful suggestions; for additional information, please click below..

We addressed, "well, in order to understand just how much you need to be paying, we require to know just how much you're making. What are your profits like? What is your take-home pay? Are you in any financial obligation?" There was a long pause. "Well, I have $179,000 in my account, so I presume my web income (revenues much less expenses) is $18K".

Some Known Questions About Stonewell Bookkeeping.

While maybe that they have $18K in the account (and also that could not hold true), your equilibrium in the bank does not necessarily establish your earnings. If someone got a grant or a funding, those funds are ruled out income. And they would certainly not function right into your revenue declaration in identifying your profits.

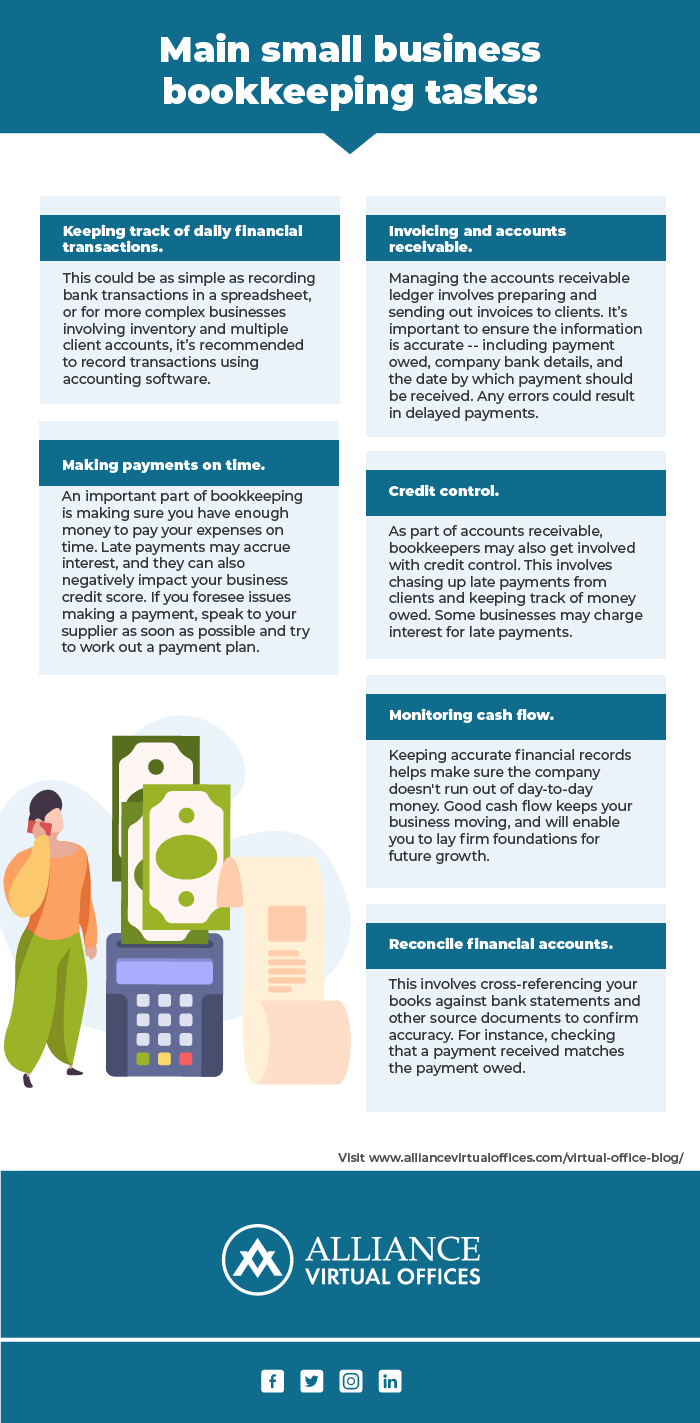

Lots of points that you think are costs and reductions are in fact neither. An appropriate collection of publications, and an outsourced bookkeeper that can appropriately identify those transactions, will assist you recognize what your business is truly making. Accounting is the procedure of recording, identifying, and organizing a company's monetary deals and tax obligation filings.

An effective service calls for aid from experts. With practical goals and a skilled bookkeeper, you can conveniently attend to obstacles and keep those worries at bay. We dedicate our power to guaranteeing you have a strong economic foundation for growth.

Unknown Facts About Stonewell Bookkeeping

Accurate bookkeeping is the backbone of excellent financial management in any type of service. It assists track earnings and costs, ensuring every deal is videotaped appropriately. With good bookkeeping, services can make much better decisions because clear financial documents use useful data that can guide strategy and enhance earnings. This info is essential for long-term preparation and projecting.

Accurate economic statements construct trust with loan providers and investors, enhancing your opportunities of obtaining the capital you require to grow., companies need to regularly resolve their accounts.

They ensure on-time payment of costs and quick consumer negotiation of invoices. This boosts capital and aids to prevent late fines. An accountant will go across bank statements with internal documents at least as soon as a month to discover blunders or variances. Called bank reconciliation, this procedure assures that the financial records of the Full Report company suit those of the financial institution.

Money Circulation Statements Tracks money activity in and out of the service. These records help company proprietors understand their financial setting and make educated decisions.

The Buzz on Stonewell Bookkeeping

While this is affordable, it can be taxing and vulnerable to mistakes. Devices like copyright, Xero, and FreshBooks enable business owners to automate accounting tasks. These programs aid with invoicing, bank reconciliation, and economic coverage.